Global Energy Outlook

Global Energy Outlook (EnerOutlook) is a free online interactive data software, allowing to browse data through intuitive maps and graphs, for a visual analysis of the expected long-term trends in the energy industry.

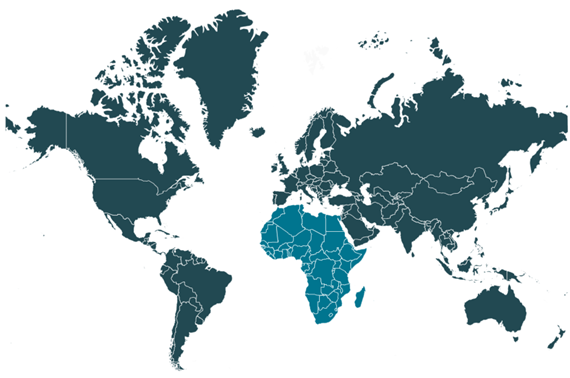

These can be viewed globally and by world region. The interface provides robust projections on energy supply and demand as well as information on fossil fuel prices, renewable energies and CO2 emissions.

This application is an excerpt of the complete EnerFuture global forecast service based on the POLES model.

Three global energy and climate scenarios are considered in EnerFuture:

- EnerBase: describes a world in which existing policies and historical trends are continued without any further climate ambition.

- EnerBlue: based on the successful achievement of NDCs (Nationally Determined Contributions) and other national pledges.

- EnerGreen: explores the implications of more stringent climate policies leading to limit the global temperature increase to well below 2°C.

Access projections:

- On total primary and final consumption, with details for electricity and renewable energies;

- On CO2 emissions;

- On energy and climate indicators;

- Covering the whole world with 7 regional groupings;

- With a dedicated tab for snapshots on sampled countries (Brazil, Canada, Hungary, Turkey and Vietnam);

- Including data up to 2050 ;

- With detailed results from the EnerBlue scenario, as well as key figures from the EnerBase and EnerGreen scenarios.

Free data export in *.xlsx files for advanced analysis.

Our forecasting experts just released the 2025 edition of our 2050 Global Energy & Climate scenarios.

More informationKey Global Figures - EnerBlue scenario

EnerFuture provides energy projections up to 2050. Our service offers clear insight into the future of energy demand, prices and GHG emissions.

More informationEnerdata's long-term MACC allow you to gain unique insight and comprehensive data from the globally recognised POLES model.

More information