Global Energy Outlook

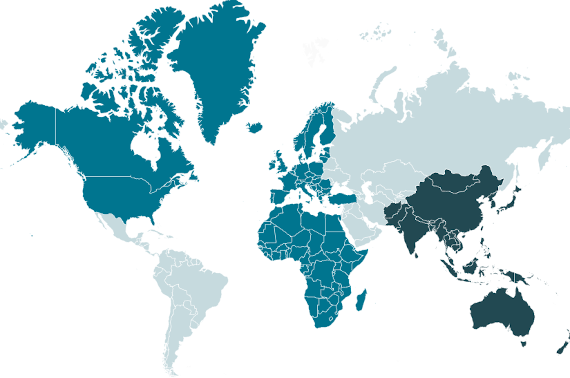

Global Energy Outlook (EnerOutlook) is a free online interactive data software, allowing to browse data through intuitive maps and graphs, for a visual analysis of the expected long-term trends in the energy industry.

These can be viewed globally and by world region. The interface provides robust forecasts on energy supply and demand as well as information on fossil fuel prices, renewable energies and CO2 emissions.

This application is an excerpt of the complete EnerFuture global forecast service based on the POLES model.

Three global energy and climate scenarios are considered in EnerFuture:

- EnerBase: a Business-As-Usual scenario in which historical trends in energy consumption and related emissions are maintained until 2050.

- EnerBlue: a scenario based on the successful achievement of the Nationally Determined Contributions (NDCs).

- EnerGreen: an ambitious scenario allowing to limit the global temperature increase below 2°C by 2100.

Access projections:

- On total primary and final consumption, with details for electricity and renewable energies;

- On CO2 emissions;

- On energy and climate indicators;

- Covering the whole world with 7 regional groupings;

- With a dedicated tab for snapshots on sampled countries (Brazil, Canada, Hungary, Turkey and Vietnam);

- Including data up to 2050 ;

- With detailed results from the EnerBlue scenarios, as well as key figures from the EnerBase and EnerGreen scenario.

Free data export in *.xls files for advanced analysis.

Our forecasting experts just released the 2023 edition of our 2050 Global Energy & Climate scenarios.

More informationEnerFuture provides energy projections up to 2050. Our service offers clear insight into the future of energy demand, prices and GHG emissions.

More informationEnerdata's long-term MACC allow you to gain unique insight and comprehensive data from the globally recognised POLES model.

More information25

Apr

The Russian Ministry of Economic Development has lowered its forecasts for the country's crude oil export prices over the 2024-2027 period to US$65/bbl. The forecasts were cut from previous estimates of US$71.3/bbl for 2024, US$70.1/bbl for 2025 and US$70/bbl for 2026.

22

Apr

The European Union Agency for the Cooperation of Energy Regulators (ACER) has published its European LNG Market Monitoring Report (MMR). According to the report, the EU outpaced China as the largest global LNG importer in 2023, with 134 bcm of LNG imports recorded, while the United States have surpassed Qatar and Australia as the largest LNG producer, with an estimated export volume of 119 bcm in 2023. The EU’s increased demand of LNG may reach its peak during 2024 under ‘REPowerEU’ demand scenarios, at 330 bcm.

11

Apr

According to a white paper from the China Energy Storage Alliance (CNESA), China’s battery storage capacity addition is expected to slow down from 34.5 GW in 2023 to 30.1 GW in 2024 (-13%) under conservative estimates, as energy storage struggles with low profitability, cause most notably by high upfront costs. With more favourable conditions, new addition in China are forecast to increase by almost a fifth in 2024 to 41.2 GW, which remains, however, below the projected 35% global growth rate of battery storage capacity addition. China needs battery storage as a back up to integrate rising intermittent renewables capacity into power grids, in a context where gas-fired capacity is limited.

10

Apr

The local Chinese government of the Shanxi province has published the "2024 Work Plan for Stable Coal Production and Supply in Shanxi Province", proposing a slight reduction in the coal output to reach 1.3 Gt during 2024. Citing safety concerns and weak demand that caused a fall in prices, the province will voluntarily reduce 4% of its coal output from the 1.36 Gt produced in 2023. However, production is expected to increase in the coming months to reach the 1.3 Gt of coal during 2024, due to mines working under 70% of the registered production capacity because of production restrictions.